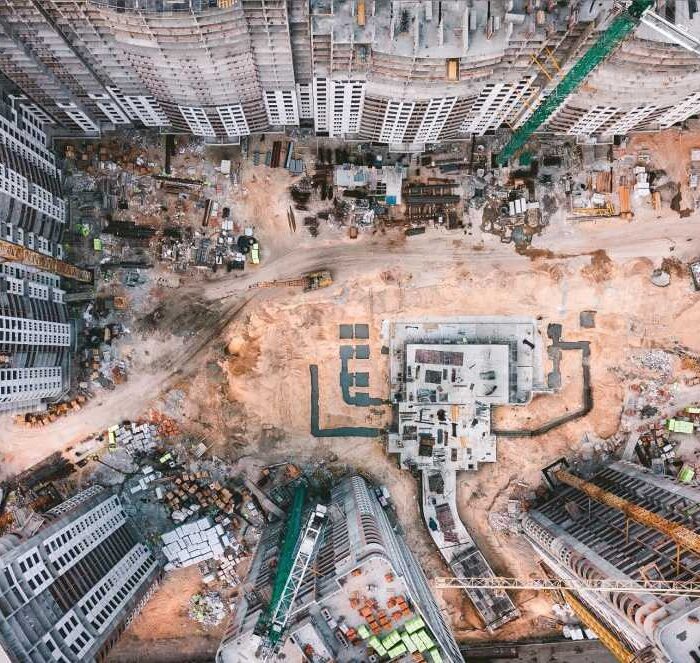

- Details of the development site – location, value, the purchase price

- Development appraisal

- Development costs

- Details of the planning permission – what does the site have planning for and what are you planning to build

- Details of all the applicants, if a limited company then details about the directors:

- Asset and Liability Statement for all applicants and company

- Experience with previous development

- Development and Marketing team details

- Company Structure

Talk To Your Skilled Acquisition and Development Financing Mortgage Solution Provider

If you decide to venture into a development project, don’t leave it to chance. If you are having trouble arranging financing, talk to a professional and experienced mortgage solution provider like Freedom Capital. We will do our best to assist you in finding the right kind of mortgage for your development property.