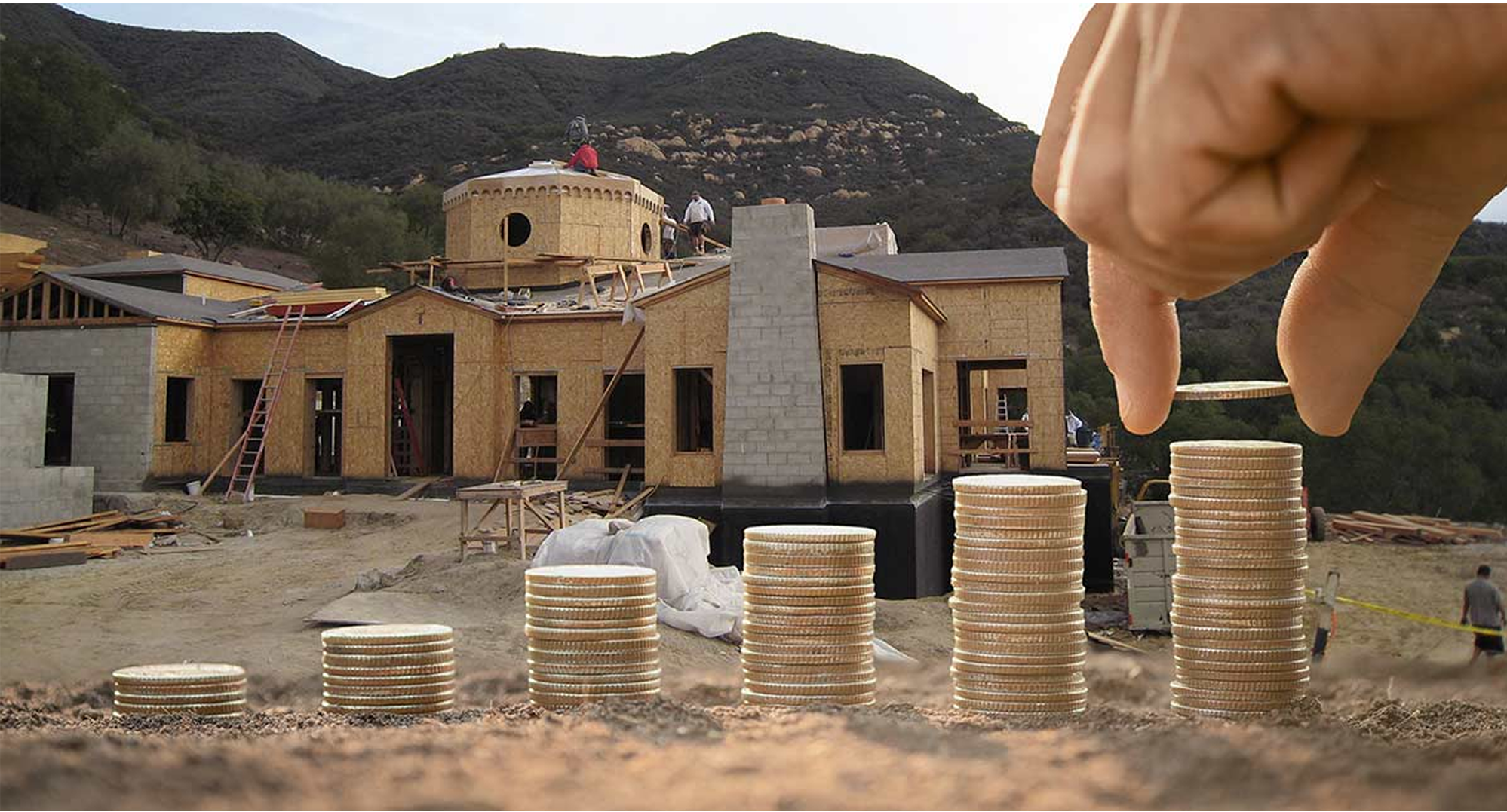

Repeat clients looking to take advantage of the increase in property values. We were able to provide them with a $600K equity take-out so they could build additional space in order to generate rental income and further increase the property value.

Financing for Construction Funds to Build on another Property

Mortgage Amount : $1,700,000.00